Vietnam has established itself as one of Asia’s fastest-growing economies, with exports being the backbone of its trade-driven growth model. Over the past decade, the country has transformed from a primarily agricultural economy into a global manufacturing hub. With its strategic location in Southeast Asia, competitive labor costs, favorable trade agreements, and strong foreign direct investment (FDI), Vietnam is now a central player in global supply chains.

According to Vietnam export data, the total value of Vietnam exports reached $403.2 billion in 2024, a 6.4% increase from the previous year. In the first quarter of 2025 alone, exports totaled $102.8 billion, reflecting a year-on-year growth of 10.6%. With a total trade turnover of $202.5 billion in the same quarter, Vietnam continues to strengthen its global trade presence, achieving a trade surplus of $4.67 billion in the first five months of 2025.

In this article, we take a closer look at the top Vietnam exports products, major trade partners, and the leading exporters that are shaping the country’s economy in 2025.

Top Vietnam Exports: Major Products by HS Code

Vietnam is recognized for its diverse export portfolio, ranging from high-tech electronics to traditional agricultural goods. The country’s trade competitiveness lies in its ability to balance both modern manufacturing and agri-based exports. Based on Vietnam export statistics, here are the top 10 Vietnam exports products for 2024–25:

-

Electrical Machinery & Equipment (HS Code 85): $121.7 billion

Electronics dominate Vietnam exports, accounting for 29.5% of total export value. Companies like Samsung, Intel, and LG have major production facilities in Vietnam, making the country a vital hub for global electronics manufacturing. -

Footwear (HS Code 64): $25.4 billion

Vietnam ranks as one of the world’s leading footwear exporters, supplying major international brands. The sector contributes 6.1% of total exports. -

Machinery & Mechanical Appliances (HS Code 84): $23.5 billion

Including engines, pumps, and machinery parts, this sector makes up 5.7% of exports. -

Knit Apparel (HS Code 61): $21.2 billion

Garments like t-shirts and sweaters remain crucial to Vietnam’s textile industry. -

Non-Knit Apparel (HS Code 62): $19.7 billion

Jackets, suits, and skirts are widely exported, representing 4.8% of total exports. -

Furniture and Bedding (HS Code 94): $14.2 billion

Vietnam has become a leading furniture supplier to markets like the U.S. and EU. -

Fish and Seafood (HS Code 03): $9.8 billion

Shrimp, squid, and other seafood exports account for 2.4% of exports. -

Wood and Wood Articles (HS Code 44): $6.5 billion

A growing category that includes wooden furniture, particle boards, and plywood. -

Coffee, Tea, and Spices (HS Code 09): $5.6 billion

Vietnam is the world’s second-largest coffee exporter, supplying high-quality beans globally. -

Rubber and Articles (HS Code 40): $4.3 billion

Exported products include tires, gloves, and rubber bands.

This diversification of Vietnam exports products has allowed the country to remain resilient despite global trade uncertainties.

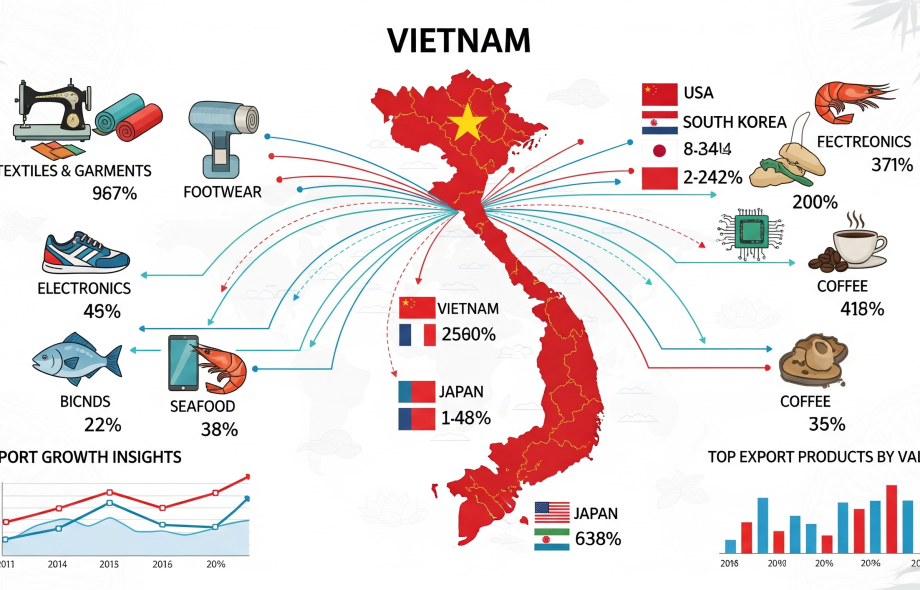

Vietnam Exports by Country: Top Trading Partners

Vietnam’s success as an export powerhouse is closely tied to its global trade partnerships. According to Vietnam customs data, the top 10 export destinations in 2024–25 are:

-

United States: $113.9 billion (27.5%)

The U.S. remains Vietnam’s largest export market, with strong demand for electronics, textiles, and seafood. -

China: $60.7 billion (14.7%)

China is both a supplier of raw materials and a buyer of Vietnamese exports, especially electronics and agricultural products. -

South Korea: $28.2 billion (6.8%)

Strong ties exist in electronics, textiles, and machinery trade. -

Japan: $26.8 billion (6.5%)

Japan imports seafood, textiles, and electronics from Vietnam. -

Hong Kong: $20.1 billion (4.9%)

Plays a key role as a re-export hub for Vietnamese products. -

Germany: $14.7 billion (3.6%)

Focused on machinery, electronics, and chemicals. -

Netherlands: $10.3 billion (2.5%)

A vital European gateway for Vietnamese agricultural and industrial exports. -

United Kingdom: $9.2 billion (2.2%)

Imports a wide variety of apparel, electronics, and footwear. -

Thailand: $8.8 billion (2.1%)

Strong regional trade in machinery, agriculture, and electronics. -

India: $7.5 billion (1.8%)

Vietnam exports textiles, agriculture products, and electronics to India.

This overview of Vietnam exports by country highlights the diversification of Vietnam’s global trade network. The U.S. and China dominate, but Vietnam’s outreach to the EU and Asia-Pacific markets adds resilience against external shocks.

Top Exporters in Vietnam: Leading Companies

Vietnam’s export boom is supported by both multinational corporations and domestic companies. Some of the most significant contributors to Vietnam exports include:

-

Samsung Group (Vietnam): $65 billion – Smartphones, TVs, and electronics.

-

Intel Products Vietnam: $12.9 billion – Semiconductors and chips.

-

LG Group: $8.2 billion – Display panels and electronic parts.

-

Foxconn (Hon Hai Group): $4.5 billion – Electronics assembly for Apple and others.

-

NatSteelVina: $8 billion – Steel and construction materials.

-

VINATEX: $800 million – Garments and textiles.

-

Intimex Group: $320 million – Coffee exports.

-

Vinamilk: $180 million – Dairy products.

Samsung remains the largest contributor, accounting for a significant share of Vietnam exports products, while local players like Vinamilk and Intimex highlight Vietnam’s strength in agricultural and food exports.

Vietnam Import Export Data: Historical Trends

Looking at Vietnam import export data from the past decade shows consistent growth:

-

2014: $150.2 billion

-

2017: $215.1 billion

-

2020: $281.4 billion

-

2022: $370.9 billion

-

2024: $403.2 billion

Despite global challenges like the pandemic and tariff risks, Vietnam has shown resilience. The country’s export model, heavily supported by FDI and trade agreements like EVFTA, CPTPP, and RCEP, continues to drive its growth.

Tariff and Policy Impacts

Vietnam’s exports face challenges due to shifting tariff policies. U.S. Section 232 tariffs on steel (25%) and aluminum (25%) have added cost pressures. Additionally, proposed “reciprocal” tariffs of up to 46% could pose risks if enacted. However, Vietnam has managed to cushion these shocks through trade diversification and by leveraging free trade agreements.

Forward Outlook for Vietnam Exports in 2025

Looking ahead, Vietnam exports are projected to grow by 10–15% in 2025, potentially crossing the $450 billion mark. Growth will be driven by:

-

Strong demand for electronics, textiles, and agricultural goods.

-

Expansion of supply chain relocation from China to Vietnam.

-

Increased utilization of FTAs for tariff-free access.

-

Rising domestic manufacturing capabilities.

However, risks remain in the form of U.S.–China trade tensions, tariff uncertainties, and stricter EU environmental regulations.

Conclusion

Vietnam has emerged as a global export powerhouse, with a diverse export portfolio that includes electronics, textiles, footwear, furniture, seafood, coffee, and more. With strong trade relationships across the U.S., China, and the EU, Vietnam is well-positioned to maintain its momentum in global trade.

By analyzing Vietnam exports by country, leading exporters, and the evolving trends in Vietnam import export data, it becomes clear that Vietnam is not only a hub for cost-competitive production but also a long-term strategic partner in global supply chains. For businesses, staying updated with Vietnam export data is essential to identify new opportunities, manage risks, and make informed trade decisions.

:

https://in.pinterest.com/tradeimex

:

https://in.pinterest.com/tradeimex