In the dynamic realm of global trade, the Vietnam-China trade relationship has emerged as one of Asia’s most significant and complex economic partnerships. Built on decades of cooperation, regional proximity, and deeply intertwined supply chains, this bilateral trade corridor has witnessed substantial growth in recent years. In particular, Vietnam imports from China have soared to record levels, highlighting China’s position as Vietnam’s largest import partner and a key player in its industrial rise.

According to recent Vietnam customs data, imports from China reached $144.02 billion in 2024, marking a 12% year-over-year increase. In the first quarter of 2025 alone, bilateral trade surged to $51.25 billion—a 17.46% increase compared to the same period in 2024. This article explores the factors driving this growth, highlights top import categories, and examines the strategic implications of this booming trade relationship.

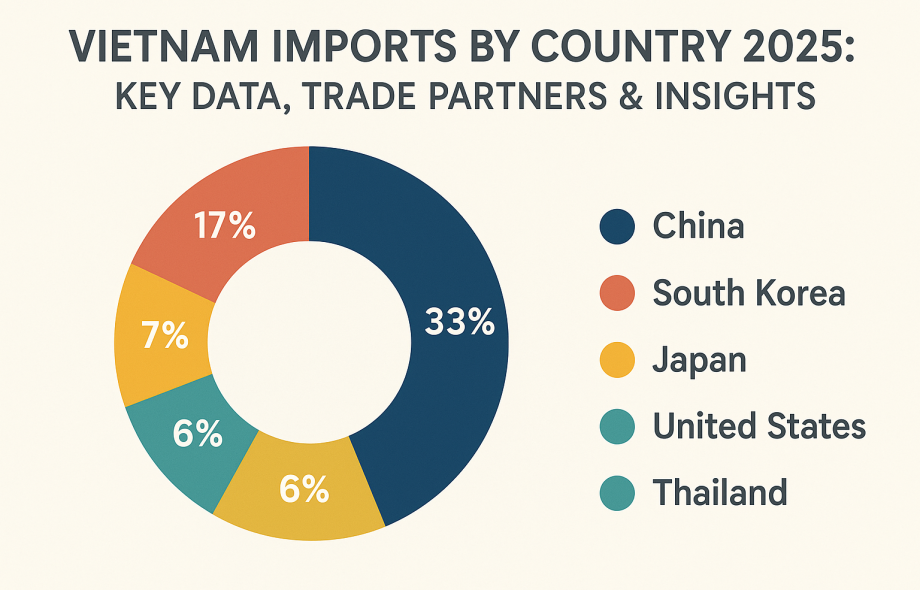

Vietnam-China Trade in 2024-25: An Overview

The Vietnam-China trade corridor has achieved historic highs. In 2024, total bilateral trade between the two nations reached $205.2 billion, according to the General Department of Vietnam Customs, with Vietnam importing a staggering $144 billion from China. China’s own figures present an even broader scope, suggesting the bilateral trade reached $260.65 billion, including exports of $161.9 billion to Vietnam and imports of $98.8 billion from Vietnam.

This sharp rise has deepened Vietnam’s trade deficit with China—from $49 billion in 2023 to approximately $82.8 billion in 2024. And the trend is accelerating. In the first half of 2025, Vietnam imports from China alone hit $84.7 billion, accounting for 40% of the country’s total imports.

Top 10 Vietnam Imports from China in 2024-25

China’s role as a manufacturing powerhouse enables it to supply Vietnam with a wide range of industrial and consumer goods. As per Vietnam’s import statistics, the top imports from China in 2024-25 include:

-

Electrical machinery & equipment (HS code 85) – $58.60B (36.2%)

-

Machinery and nuclear reactors (HS code 84) – $18.53B (11.5%)

-

Plastics & plastic articles (HS code 39) – $8.19B (5.1%)

-

Iron & steel (HS code 72) – $7.27B (4.5%)

-

Knitted or crocheted fabrics (HS code 60) – $5.07B (3.1%)

-

Man-made filaments (HS code 54) – $3.79B (2.3%)

-

Articles of iron or steel (HS code 73) – $3.66B (2.3%)

-

Vehicles (HS code 87) – $3.30B (2.0%)

-

Commodities not specified (HS code 99) – $3.08B (1.9%)

-

Medical & optical instruments (HS code 90) – $2.19B (1.4%)

Notably, electrical and mechanical goods accounted for nearly 45% of all Vietnam imports from China, reinforcing the idea that China is Vietnam’s essential partner in fueling industrial growth.

Why Vietnam Imports from China Matter

1. Powering Export-Driven Manufacturing

China supplies Vietnam with critical electronic components and machinery that are essential for Vietnam’s role as a global exporter of smartphones, computers, textiles, and furniture. These inputs are the foundation of Vietnam’s manufacturing ecosystem.

2. Accelerating Industrial Upgrading

Vietnam’s goal to move from basic assembly to high-value manufacturing requires capital-intensive imports—such as smart machinery, automation systems, and specialized tooling—all of which are sourced significantly from China.

3. Meeting Growing Consumer and Auto Demand

In the first half of 2025, imports of auto components and complete vehicles from China rose by 78% and 64% respectively. This underscores Vietnam’s growing middle class and rising consumer purchasing power.

Historical Growth of Vietnam Imports from China (2014–2025)

Vietnam’s reliance on Chinese imports has grown consistently over the past decade:

| 2014 | $43.64 billion |

| 2015 | $49.44 billion |

| 2016 | $50.03 billion |

| 2017 | $58.53 billion |

| 2018 | $65.51 billion |

| 2019 | $75.58 billion |

| 2020 | $84.19 billion |

| 2021 | $109.85 billion |

| 2022 | $117.65 billion |

| 2023 | $110.65 billion |

| 2024 | $144.02 billion |

| 2025 (Q1) | $84.70 billion |

Trade Agreements and Bilateral Cooperation

Vietnam and China’s trade is governed by a mix of bilateral and multilateral agreements:

-

ASEAN-China Free Trade Area (ACFTA): Eliminated tariffs on 90% of goods.

-

RCEP: A broader pact that enhances regional cooperation.

-

Infrastructure Collaboration: Agreements on cross-border transport, smart customs, and energy.

In 2023, both countries signed 37 agreements covering green development, e-commerce, digital infrastructure, and high-tech agriculture.

Strategic Considerations

Vietnam’s trade with China is deeply strategic. It imports raw materials, capital goods, and essential components, while exporting agricultural products and assembling exports for global markets. However, this relationship presents challenges:

-

Overdependence Risk: Vietnam must diversify its sourcing to hedge against supply chain disruptions.

-

U.S. Scrutiny: Allegations of Chinese goods being transshipped through Vietnam have led to tighter rules of origin enforcement.

-

Infrastructure Ties: Planned projects like high-speed rail could deepen China’s influence over Vietnam’s transport corridors.

Looking Ahead: Balancing Growth with Sovereignty

Vietnam faces a delicate balancing act: leveraging Chinese inputs while asserting economic autonomy. Policymakers are focused on:

-

Diversifying Imports (e.g., sourcing from ASEAN, India, South Korea)

-

Promoting Local Manufacturing to reduce external dependency

-

Tightening Trade Rules to avoid conflicts with major partners like the U.S.

The Vietnam-China trade relationship will remain crucial in 2025 and beyond—but its future will be shaped by how Vietnam navigates geopolitical risks while sustaining industrial growth.

Conclusion

The rise in Vietnam imports from China reflects not just commercial exchange but a structural alignment of two interconnected economies. As Vietnam continues on its path of industrialization and export-led growth, its dependence on Chinese machinery, electronics, and raw materials is likely to persist. However, ensuring trade resilience and economic sovereignty will require strategic foresight, diversified partnerships, and smart policymaking.

For more comprehensive trade data insights or to explore Vietnam’s top importers, connect with VietnamExportData. Contact us at info@tradeimex.in for customized trade reports and verified importer lists.

:

https://in.pinterest.com/tradeimex

:

https://in.pinterest.com/tradeimex