Lithium is more than just a mineral—it is the foundation of today’s digital and green economy. From smartphones and laptops to electric vehicles (EVs) and renewable energy storage, lithium powers the technologies that define modern life. The United States, despite heavy investments in domestic mining and gigafactories, continues to depend heavily on us lithium imports by country. This dependence highlights not just an economic issue but also a geopolitical and strategic one.

According to the latest us import export trade data, the total value of us lithium imports (cells and batteries under HS Code 850650) reached $432.36 million in 2024, marking a 9% decline from 2023. For the first half of 2025, imports already stood at $205.29 million, confirming America’s strong reliance on global suppliers.

In this article, we provide a detailed look at us lithium imports by country, historical trade data, supplier breakdowns, tariffs, and supply chain vulnerabilities shaping America’s clean energy future.

The Scale of US Lithium Imports

Lithium batteries under HS Code 850650 form a multi-billion-dollar segment of global trade. In 2024, worldwide imports of lithium primary cells and batteries totaled $3.80 billion, weighing nearly 47 kilotonnes. The U.S. alone accounted for over $432 million of this global trade, proving its position as one of the largest buyers worldwide.

Historical us import export trade data shows that lithium imports have remained a crucial part of the U.S. economy for the last decade. For example:

-

2014: $328.51 million

-

2018: $391.83 million

-

2022: $419.39 million

-

2023: $477.71 million

-

2024: $432.36 million

This decade-long trend highlights that even with domestic efforts, us imports of lithium batteries have not slowed significantly.

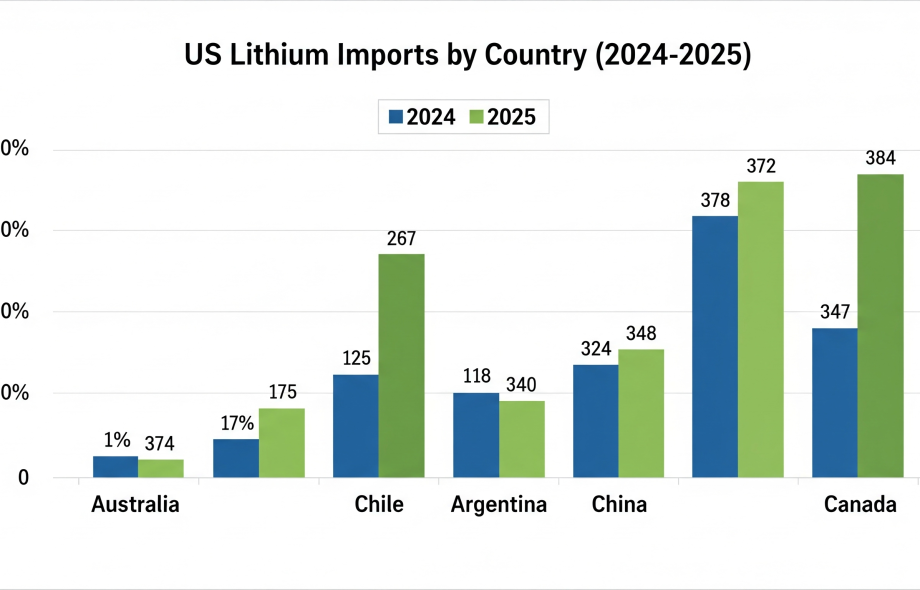

US Lithium Imports by Country 2024–25

Understanding us lithium imports by country is essential to see where America’s dependence lies. The U.S. sources its lithium cells and batteries from a diverse mix of Asian, North American, and European suppliers.

Here’s the breakdown of the top 10 lithium suppliers in 2024–25:

-

China – $79.33 million (18.3%)

China remains the top supplier, holding nearly one-fifth of the U.S. lithium battery imports. Its stronghold comes from dominance in battery manufacturing and cost competitiveness. -

Singapore – $73.70 million (17%)

Acting as a trade hub, Singapore channels lithium products from Asia-Pacific into the U.S. market. -

Israel – $61.32 million (14.2%)

Known for advanced lithium technologies, Israel provides niche but critical supplies. -

Japan – $39.92 million (9.2%)

With innovation-driven companies like Panasonic and Maxell, Japan contributes significantly. -

Canada – $33.39 million (7.7%)

Geographic proximity and natural reserves make Canada a reliable partner. -

South Korea – $32.05 million (7.4%)

Home to LG Energy Solution and Samsung SDI, South Korea plays a central role in the EV supply chain. -

France – $30.39 million (7%)

France specializes in defense-grade and industrial lithium products. -

Indonesia – $26.27 million (6.1%)

A growing supplier due to rising investments in lithium production. -

Mexico – $14.71 million (3.4%)

Mexico’s growing battery sector and proximity to the U.S. make it increasingly important. -

Germany – $8.23 million (1.9%)

A small but significant supplier, focusing on high-quality battery technology.

This supplier mix clearly shows Asia dominating the U.S. lithium market, while Europe and North America act as secondary but essential contributors.

Why the U.S. Still Relies on Imports

Despite efforts to strengthen domestic production, us lithium imports by country data reveals that America cannot meet its own demand. The reasons are:

-

Limited domestic reserves – The U.S. has lithium deposits but lacks large-scale mining operations.

-

Gigafactories focus on assembly – Plants by Tesla, Panasonic, and GM primarily assemble batteries rather than producing raw lithium cells.

-

Specialized needs – Certain industrial, defense, and medical applications require niche batteries primarily made in Asia and Europe.

For now, us lithium imports remain critical for supporting industries from consumer electronics to national defense.

Import Tariffs and Trade Mechanics

Lithium batteries (HS 850650) face a 2.7% MFN tariff rate in the U.S. This means that a $30 million monthly import bill creates nearly $810,000 in tariffs, directly influencing sourcing decisions.

Free trade agreements (FTAs) with countries like Chile offer exemptions, which could become more significant as the U.S. looks to diversify away from China. These trade structures make us import export trade data an important tool for businesses and policymakers to analyze sourcing strategies.

Geopolitical and Supply Chain Risks

Trade data only tells part of the story—geopolitical and supply risks amplify America’s dependence.

-

China factor: Cheap and abundant, but politically risky. Policy shifts could disrupt supply.

-

Allies as alternatives: Japan and South Korea remain stable partners with advanced capabilities.

-

European niche suppliers: France and Germany, though smaller players, supply critical defense-grade batteries.

-

Emerging suppliers: Indonesia and Mexico are building their presence in global lithium trade.

The Inflation Reduction Act (IRA) incentivizes sourcing from free trade partners, which could shift U.S. lithium sourcing strategies in the coming years.

The Path Ahead for U.S. Lithium Imports

Looking forward, us lithium imports by country are expected to stay above $350–400 million annually. While domestic production ramps up, especially in rechargeable EV-grade lithium-ion cells (HS 850760), primary lithium cells (HS 850650) will continue to be imported at high levels.

This means us imports will remain structurally necessary, particularly for industries where reliability and specialization matter more than scale.

The U.S. challenge is clear:

-

Build resilience into supply chains

-

Balance cost and security

-

Diversify sourcing away from overdependence on China

Conclusion

In 2025, the U.S. remains deeply dependent on us lithium imports by country, especially from Asia. With imports worth hundreds of millions of dollars each year, American companies like Duracell, Panasonic, Maxell, and NextEra continue to rely on international suppliers for lithium cells and batteries.

Even as domestic gigafactories grow, the focus remains on EV-grade lithium-ion cells, not primary lithium batteries. This ensures that us lithium imports under HS 850650 will remain strategically vital for years to come.

For businesses, policymakers, and investors, monitoring us import export trade data is essential to anticipate shifts in costs, tariffs, and supplier risks.

The global race for lithium is not just about economics—it is about energy security, technological competitiveness, and geopolitical influence in the 21st century.

:

https://in.pinterest.com/tradeimex

:

https://in.pinterest.com/tradeimex